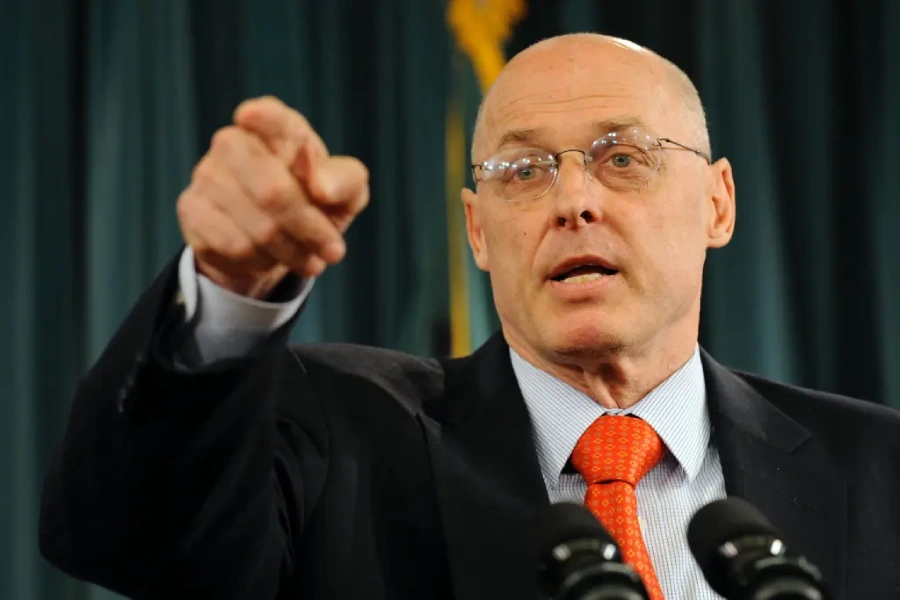

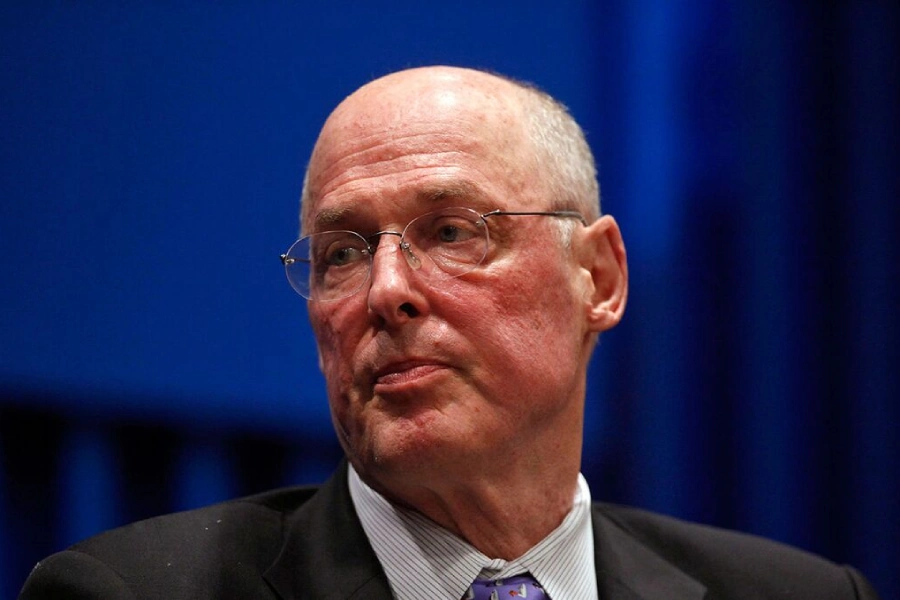

The 2008 financial crisis is still fresh in many minds—not just as a historic economic shock but as a stark lesson in how fragile the U.S. financial system can be. Hank Paulson, the former Treasury Secretary who led the government’s response to that crisis, is now sounding a serious alarm about another danger lurking in the U.S. Treasuries market, worth a staggering $29 trillion. But this time, it’s not just about economics—it’s about deep legal and political risks that could shake the foundation of global finance.

Paulson’s warning isn’t a casual observation. It comes with a sense of urgency shaped by his unique experience managing the 2008 meltdown, when financial markets froze, banks teetered on collapse, and legal authority was pushed to its limits. Today, Paulson and his successor Timothy Geithner warn of a growing risk rooted in the unsustainable fiscal path of the U.S. government and persistent political gridlock. Understanding this warning requires diving into the complex legal framework that governs U.S. debt—and why that framework might soon face unprecedented challenges.

Why Hank Paulson’s Voice Matters

Before diving into the legal nitty-gritty, it’s important to understand why Paulson’s perspective carries such weight. As Treasury Secretary from 2006 to 2009, Paulson was at the center of the storm during one of the most volatile periods in modern history. The 2008 crisis forced the government to take extraordinary legal steps—like creating the Troubled Asset Relief Program (TARP), a $700 billion bailout—to keep the banking system afloat.

That experience gave Paulson a front-row seat to the limits of existing laws when facing systemic risk. When he talks about current dangers, he’s not theorizing—he’s speaking from firsthand knowledge of how the law, markets, and politics collide under pressure.

The Legal Backbone of U.S. Debt: What Could Go Wrong?

The U.S. Treasury market is often called the safest asset in the world. This reputation relies on a strong legal and institutional foundation:

-

Congressional Authority Over Debt: The U.S. Constitution grants Congress the power to borrow money on the country’s behalf. This means federal borrowing isn’t just an economic issue—it’s a legal and political one. Congress must authorize debt issuance, approve budgets, and, importantly, raise the debt ceiling when necessary.

-

The Debt Ceiling: This is a statutory limit on how much debt the government can issue. When the ceiling is reached, Congress must pass legislation to raise it, or the government risks defaulting on its obligations. Over the years, this process has become a political flashpoint, with brinkmanship causing uncertainty in markets.

-

The Treasury’s Authority and Emergency Powers: In a crisis, the Treasury Department and the Federal Reserve have certain legal tools to manage debt and liquidity, but these powers have limits. For example, the Treasury can prioritize payments temporarily but cannot legally create new debt beyond the ceiling without Congressional approval.

-

Default and Its Legal Consequences: If the U.S. government fails to meet its debt obligations, it would technically be in default. This could trigger lawsuits, disrupt global markets, and erode trust in U.S. debt instruments. The legal ramifications would be vast and unprecedented, given the U.S. dollar’s central role in the world economy.

The Growing Risk: Political Gridlock Meets Fiscal Unsustainability

Paulson’s main concern isn’t just the size of the debt—it’s the inability of the political system to address it effectively. Unlike in 2008, when quick emergency action (however controversial) was possible, today’s political environment is deeply divided.

-

Repeated Debt Ceiling Standoffs: In recent years, political battles over raising the debt ceiling have become routine. These fights increase legal uncertainty and risk a partial government shutdown or even a default if no agreement is reached.

-

Legal Ambiguity Around Prioritization: Some legal experts argue that, if faced with a debt ceiling crisis, the Treasury might prioritize interest payments on debt to avoid default but delay other obligations. However, this approach is untested and legally murky—raising questions about executive power and Congressional intent.

-

Potential Constitutional Conflicts: The debt ceiling crisis could ignite constitutional debates over separation of powers. For example, if the Treasury acts without Congress’s explicit approval, it could provoke lawsuits or constitutional challenges. Conversely, if Congress refuses to act, the executive branch faces legal and practical dilemmas about managing debt obligations.

Lessons from 2008: How Legal Authority Was Tested

The 2008 crisis forced the government to stretch legal boundaries. Paulson’s role in TARP is a prime example:

-

Unprecedented Use of Emergency Powers: TARP involved the government buying toxic assets and injecting capital into private banks, actions never before attempted on that scale. These moves required creative legal interpretations and faced criticism over executive overreach.

-

Legal Challenges and Moral Hazard: Critics argued that such bailouts created moral hazard—rewarding risky behavior. But Paulson defended these decisions as necessary to stabilize the system.

-

Lehman Brothers vs. AIG: Paulson had to make difficult legal and political calls about who to save and who to let fail, balancing market consequences with legal authority.

These experiences showed that, in a crisis, existing laws may be insufficient or ambiguous, forcing quick, high-stakes legal judgments. Paulson worries the next crisis, driven by debt and political dysfunction, could be even more challenging.

What Could Happen Next? Legal Scenarios to Watch

If political gridlock continues and the fiscal situation worsens, several troubling legal scenarios could unfold:

-

Debt Ceiling Default: If Congress fails to raise the debt ceiling, the U.S. could default on debt payments. This would be a legal crisis as much as a financial one, potentially sparking lawsuits from bondholders and disrupting the entire financial system.

-

Executive Prioritization: The Treasury might attempt to prioritize debt payments, but without clear legal backing, this could face legal challenges from Congress, courts, or creditors.

-

Government Shutdowns and Service Interruptions: Political fights could lead to extended government shutdowns, affecting everything from social programs to regulatory oversight—each with its own legal and economic ripple effects.

-

Market and Legal Uncertainty: Prolonged uncertainty undermines confidence in U.S. debt, raising borrowing costs and limiting government flexibility to respond to crises.

Why Immediate Legal and Political Action Is Critical

Paulson’s warning is ultimately a call for proactive leadership—before the next crisis hits. That means:

-

Congressional Reform: Clearer, more reliable mechanisms for managing the debt ceiling could reduce brinkmanship and legal uncertainty.

-

Strengthening Treasury Powers: Clarifying the legal scope of Treasury’s emergency powers to manage debt payments could help prevent default.

-

Political Consensus: Overcoming partisan gridlock to develop a sustainable fiscal plan is essential—not just for economic reasons, but to preserve legal credibility.

Ignoring these legal and political realities risks not only a financial crisis but also a constitutional and legal quagmire with global consequences.

Conclusion

Hank Paulson’s warning is more than just a financial forecast—it’s a legal wake-up call. The U.S. government’s enormous debt and political deadlock aren’t just economic problems; they challenge the very legal framework that has made U.S. debt the foundation of the global financial system.

As Paulson reminds us, the tools that helped navigate 2008 may not be enough next time. Without urgent legal and political action, the U.S. risks entering uncharted territory—where the consequences of default or legal battles over debt authority could be catastrophic.

For investors, policymakers, and citizens alike, understanding the legal stakes behind Paulson’s warning is crucial. It’s a reminder that economics, law, and politics are deeply intertwined—and that neglecting any of these pillars could threaten financial stability worldwide.

FAQ

1. Who is Hank Paulson and why is his opinion important?

Hank Paulson is the former U.S. Treasury Secretary who managed the 2008 financial crisis. His experience gives him valuable insights into systemic financial risks.

2. What warning did Hank Paulson recently give about the U.S. economy?

Paulson warned that the U.S. is on an “unsustainable” fiscal path due to rising debt and political gridlock, which could threaten the stability of the financial system.

3. What is the current state of the U.S. Treasury market?

The U.S. Treasury market is enormous, valued at about $29 trillion, but faces growing risks from high debt levels and political dysfunction.

4. How does Hank Paulson compare the current debt situation to the 2008 financial crisis?

He says the 2008 crisis was sudden and asset-specific, while today’s risk is slow-moving, systemic, and linked to fiscal policies and governance failures.

5. What are the legal risks of a U.S. debt default according to Hank Paulson?

A debt default could cause constitutional and legal crises, as Congress controls borrowing authority, and such a default would disrupt trust in U.S. financial obligations.

6. What is fiscal unsustainability and why is it a problem?

Fiscal unsustainability means government spending consistently exceeds revenues, causing debt to grow uncontrollably, which threatens economic stability.

7. How does political gridlock affect the U.S. financial system?

Political deadlock hinders timely fiscal reforms and budget agreements, undermining investor confidence and increasing risks in Treasury markets.

8. What actions does Hank Paulson suggest to avoid a debt crisis?

He urges lawmakers to reach bipartisan agreements on fiscal reform, reduce deficits, and restore investor trust before a crisis hits.

9. What was Hank Paulson’s role during the 2008 financial crisis?

As Treasury Secretary, Paulson led emergency interventions including the $700 billion TARP bailout to stabilize banks and prevent financial collapse.

10. Can the U.S. government legally default on its debt?

Legally, default is possible if Congress fails to raise the debt ceiling, but it would be unprecedented and highly disruptive to global markets.