In a rare display of bipartisan agreement, the U.S. Senate has unanimously passed the “No Tax on Tips Act,” a bill that could significantly impact millions of service industry workers across the country. The act, championed by Senator Ted Cruz (R-Texas) and co-sponsored by a coalition of bipartisan lawmakers including Senators Jacky Rosen and Catherine Cortez Masto of Nevada, proposes a new federal tax exemption on cash tips reported to employers. As the bill moves to the House of Representatives, public attention is intensifying around the potential consequences, legality, and fiscal impact of this legislation.

What Is the ‘No Tax on Tips Act’?

At its core, the No Tax on Tips Act aims to provide a financial cushion for tipped employees, such as waitstaff, bartenders, barbers, delivery drivers, and other service workers who frequently receive gratuities as part of their compensation. The bill proposes:

- A tax deduction of up to $25,000 annually for reported cash tips.

- An income eligibility cap of $160,000 for the 2025 tax year, indexed to inflation.

- Applicability only to tips reported through payroll systems, ensuring traceability and compliance.

This legislation represents a targeted tax relief effort, in contrast to broader tax reforms that often skew toward corporations or high-income individuals.

Why It Matters: Socioeconomic Impact

According to data from the Bureau of Labor Statistics, over 5 million Americans work in occupations where tipping is common. These individuals often face income volatility, wage disparities, and limited access to traditional benefits such as healthcare and retirement plans. For these workers, the passage of the No Tax on Tips Act could mean keeping more of their hard-earned money.

“Nevada has more tipped workers per capita than any other state,” said Sen. Rosen, who introduced the bill for a vote. “This bill would mean immediate financial relief for countless hard-working families.”

The Political Context

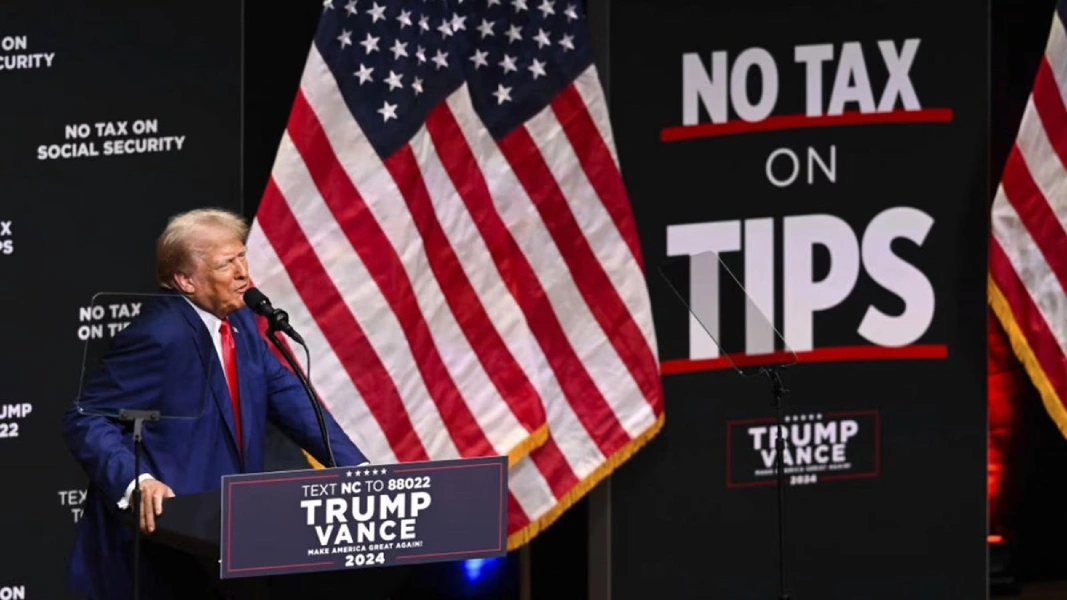

Although initially touted by former President Donald Trump as part of his campaign agenda, the bill’s unanimous Senate passage shows a rare alignment of interests between Republicans and Democrats. The Republican-led House is expected to be more than receptive to the measure, and there are discussions about whether it will be passed as a standalone bill or as part of a larger legislative package.

Senator Cruz hailed the development, saying, “No Tax on Tips is going to become law and give real relief to hard-working Americans. I’m proud of what the Senate just did, and I commend both parties for agreeing on this commonsense policy.”

Legal Analysis: Is the ‘No Tax on Tips Act’ Constitutionally Sound?

From a legal perspective, the No Tax on Tips Act appears to be a straightforward exercise of Congress’s taxing and spending powers under Article I, Section 8 of the U.S. Constitution. However, there are several areas where legal experts are closely watching:

- Tax Code Amendments: The Internal Revenue Code (IRC) will need to be amended to incorporate this new exemption, possibly under Section 62 (adjusted gross income) or Section 132 (fringe benefits).

- Enforcement & Fraud: The IRS may need to issue new regulations to prevent abuse, particularly around misreporting or falsifying tip amounts to claim deductions.

- State-Level Impacts: States that conform to federal tax codes may automatically adopt similar provisions, while others may resist.

Legal scholars note that while the bill is constitutional, its implementation could present challenges related to enforcement and administrative clarity.

Potential Economic and Fiscal Implications

The Congressional Budget Office (CBO) has not yet released a formal estimate of the bill’s fiscal impact, but preliminary projections suggest it could reduce federal tax revenues by several billion dollars annually. That revenue loss may be offset by increased consumer spending from lower-income workers who now have more disposable income.

However, critics argue that without offsetting revenue measures, the tax break could add to the national deficit. Others question whether the policy could incentivize employers to shift more compensation into tips, potentially destabilizing wage structures.

Public Reception and Controversies

The bill has garnered broad public support, particularly from service industry groups and labor advocates. “This is a long-overdue recognition of how hard tipped workers work and how little they sometimes take home,” said Maria Lopez, a hospitality union representative.

But not all voices are in favor. Some fiscal conservatives have warned that the bill opens the door to further sector-specific tax breaks, which could complicate the tax code and lead to inequities. Progressive critics, on the other hand, argue that the bill does little to address root causes like sub-minimum wage laws for tipped workers.

What’s Next?

The bill now advances to the House of Representatives, where it could be voted on within the coming weeks. If passed, President Biden would then need to sign it into law, unless he chooses to veto, which seems unlikely given its overwhelming bipartisan support.

conclusion

The No Tax on Tips Act could become one of the most significant tax changes for working-class Americans in recent memory. By easing the tax burden on those who depend on tips, the bill aims to correct a longstanding imbalance in how labor income is treated under the U.S. tax code. Still, as with any sweeping legislative change, its real-world impact will depend on precise implementation and robust oversight.

As the bill continues its legislative journey, millions of tipped workers and their families will be watching closely, hopeful for a rare win in the complex world of American tax law.

FAQ

-

What is the No Tax on Tips Act?

The No Tax on Tips Act is a U.S. law proposal that eliminates federal income tax on reported cash tips for workers earning under $160,000 annually. -

Who qualifies for the tax exemption on tips?

Workers earning $160,000 or less in 2025 and who report cash tips through their employer are eligible for this tax relief. -

Are credit card tips included in the tax exemption?

No, the exemption currently only applies to cash tips reported for payroll tax purposes. -

How much tip income can be deducted under this act?

Eligible workers can deduct up to $25,000 of reported tips per year from their taxable income. -

When will the No Tax on Tips Act become effective?

The act has passed the Senate and awaits approval in the House, with an expected effective date in late 2025 or early 2026. -

Is reporting tips to the IRS still required?

Yes, tips must still be reported to employers and the IRS even if they qualify for tax exemption. -

Does this law affect state taxes?

No, this tax exemption currently applies only to federal income tax. State tax rules may differ.